Table of Contents

ToggleNavigating the world of currency exchange can feel like a high-stakes game of poker, especially when it comes to the JPY to CAD exchange rate. One moment, the yen’s soaring like a rocket, and the next, it’s plummeting faster than a cat off a hot tin roof. For anyone looking to swap their yen for Canadian dollars, understanding this fluctuating rate is crucial.

Overview of JPY to CAD Exchange Rate

The JPY to CAD exchange rate reflects the value of the Japanese yen against the Canadian dollar. Fluctuations occur due to various factors, including economic indicators, interest rates, and geopolitical events. Traders monitor these influences closely, as they can cause rapid changes in currency values.

Current data indicates that the exchange rate may shift frequently. For instance, in recent weeks, the JPY has experienced periods of appreciation against the CAD, making Japanese imports more affordable in Canada. Conversely, if the CAD strengthens, it may lead to an increase in the yen’s conversion rate.

Market analysts provide insights into market trends that impact this exchange rate. Economic stability in Japan, reflected in GDP growth and inflation rates, plays a crucial role. In Canada, factors such as oil prices and employment rates also significantly affect the CAD’s strength against the yen.

Investors focus on these trends to optimize their currency exchanges. Tracking these variables helps individuals and businesses make informed decisions. Currency exchange platforms offer real-time updates, further aiding those participating in the market.

Understanding historical trends in the JPY to CAD exchange rate can provide context. Past performance allows observers to anticipate potential future movements. Awareness of major financial announcements from both Japan and Canada contributes to better strategic planning for currency exchanges.

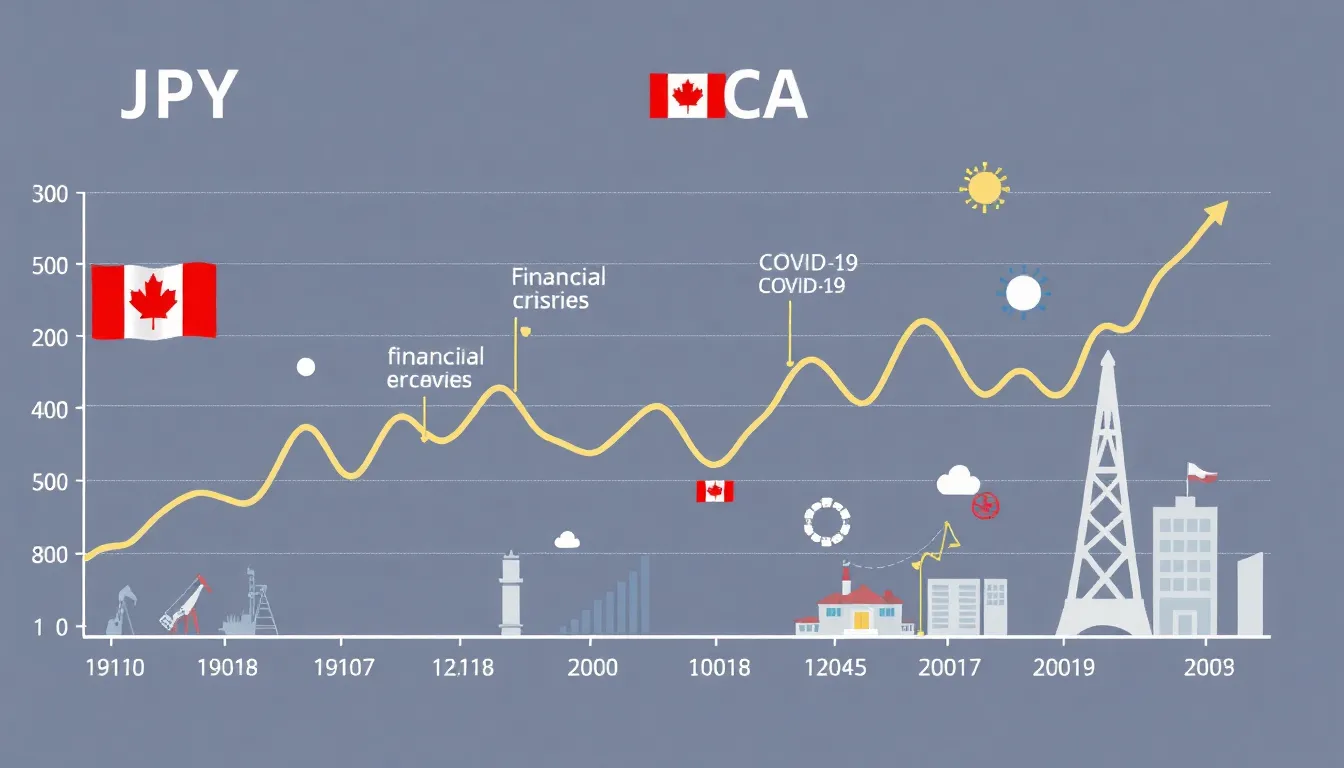

Historical Trends in JPY to CAD Exchange Rate

Examining historical trends in the JPY to CAD exchange rate reveals significant patterns shaped by various economic and geopolitical factors. Insights into these trends help traders make informed currency exchange decisions.

Key Factors Influencing Historical Changes

Economic indicators largely determine fluctuations in the JPY to CAD exchange rate. Interest rate adjustments by the Bank of Japan and the Bank of Canada influence investor sentiment, causing currency values to rise or fall. Inflation rates also play a critical role, as differing rates between Japan and Canada signal changes in purchasing power. Oil prices affect the Canadian dollar significantly, since Canada is a major oil exporter. Additionally, Japan’s trade balance impacts currency strength, with trade surpluses typically bolstering the yen against the CAD.

Major Events Impacting the Exchange Rate

Several notable events have strongly influenced the JPY to CAD exchange rate. The 2008 global financial crisis led to massive currency fluctuations as investors sought safety in the yen. Additionally, the COVID-19 pandemic created volatility due to economic uncertainties impacting both countries. Trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, also reshaped trade dynamics, thereby affecting currency values. Furthermore, changes in leadership and economic policies in either country can trigger immediate reactions in the exchange rate, demonstrating the interconnectedness of global economies.

Current JPY to CAD Exchange Rate Analysis

Current fluctuations in the JPY to CAD exchange rate reflect ongoing economic shifts. Recent trends indicate a stronger yen against the Canadian dollar, impacting import prices and overall trade dynamics.

Comparing Current Rates to Historical Averages

Current JPY to CAD rates often diverge from historical averages. Recent data reveals the yen’s value against the CAD has fluctuated, significantly influenced by interest rate changes and geopolitical events. For example, if the historical average was 0.012, current values might range between 0.0115 and 0.0125, showcasing this volatility. Comparing these rates provides insight into recent shifts in economic conditions and investor sentiment.

Short-Term vs. Long-Term Outlook

Short-term predictions suggest continued volatility in the JPY to CAD exchange rate. Analysts anticipate quick adjustments based on economic announcements and market reactions. Long-term expectations hinge on stable economic growth in Japan and Canada. A focus on inflation rates and oil price trends will play a critical role, impacting the CAD’s strength against the yen. Thus, understanding these short-term variations against a stable long-term view is essential for currency exchange decisions.

Economic Factors Affecting JPY to CAD

Understanding the JPY to CAD exchange rate requires examining key economic factors. Two primary influences are interest rates and trade relations.

Interest Rates and Monetary Policy

The Bank of Japan and the Bank of Canada heavily guide their respective currencies through interest rate policies. Increasing interest rates typically strengthen a currency, resulting in a higher JPY to CAD conversion rate. The Bank of Japan’s current monetary policy aims to combat deflation and encourage spending. Conversely, Canada’s higher interest rates and recent hikes support the CAD’s strength, particularly against the yen. Changes in these rates foster immediate reactions in the exchange market. Traders must closely watch announcements from both banks for insights into future rate adjustments and their impact on exchange rates.

Trade Relations Between Japan and Canada

Trade relations lay the foundation for currency value fluctuations. Canada imports various goods from Japan, including technology and automotive products, impacting JPY to CAD demand dynamics. Strong bilateral trade mitigates the exchange rate’s volatility, while trade disputes can introduce uncertainty. A robust and growing trading relationship enhances the Japanese yen’s value against the Canadian dollar. Analyzing trade volumes, tariffs, and trade agreements can provide context to currency fluctuations. Ultimately, market participants benefit from monitoring the health of trade relations between Japan and Canada to better anticipate currency movements.

Understanding the JPY to CAD exchange rate is crucial for anyone involved in currency trading or international transactions. The interplay of economic indicators and geopolitical events shapes this rate, creating a landscape of both opportunities and challenges.

As trends suggest ongoing volatility, staying informed about interest rates and trade relations can provide a strategic advantage. By closely monitoring these factors, individuals can make more informed decisions regarding currency exchanges.

Ultimately, recognizing the historical context and current dynamics of the JPY to CAD exchange rate will empower traders and investors to navigate the complexities of the foreign exchange market effectively.